Have you ever heard a politician advocate cutting taxes? Have you ever been alive?

Have you ever heard a politician advocate cutting taxes? Have you ever been alive?

The refrain is constant. It is pure bullshit. They tell us it will create jobs. The facts show otherwise.

I can state the facts from here to the end of ignorance and it will do no good. I can show the facts. Most people will not be persuaded. What to do? My only remaining option is to explain why it is nonsense in the simplest of terms possible.

I hope that using the word ‘reason’ will not scare off too many people.

First, a few of those facts that so many have been immunized against. The thought of cutting taxes is seductive. Very few Americans want to pay for what they want. Just think of the popularity of the lotteries, of sales. Pay attention to how frequently the word ‘free’ pops up everywhere. Cutting taxes is more popular than bad taste on reality television.

Despite the constant complaints of the government being too big and too expensive, all of us want more – more lanes on our commute, more police protection, more clerks at the department of motor vehicles, more potholes repaired, more, more, more.

Some of the same shysters calling for smaller government are proposing policies that would require a G-Man in every bedroom and doctor’s office. Perhaps they will all be volunteers.

When was the American economy most robust? In the decade or so following the Second World War. But, you say, how could that be? How, indeed? Our economy had to absorb over 10 million military men returning to civilian life. Did we cut taxes? Actually, no.

When was the American economy most robust? In the decade or so following the Second World War. But, you say, how could that be? How, indeed? Our economy had to absorb over 10 million military men returning to civilian life. Did we cut taxes? Actually, no.

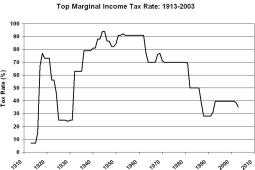

During the 1950s, the marginal tax rate was 91%. Not everyone paid that. It was just the top rate for the wealthy. That’s what is called a fact; something that causes the tax cutters dyspepsia. Their remedy is to ignore those pesky facts.

Now, the average effective tax rate for corporations is about 12% and Mitt Romney paid less than 14% on more than $20 million. Where is the economic boom? Where are the jobs?

Let’s unwrap at rare commodity – reason. If a company has more income than outgo, you have a decision to make. Do we keep it or, do we apply it to investment or expenditures? If we keep it we call it profit and pay taxes on it. If we invest it in growing or improving the company or spend it on such things as pay raises or benefits or even creating more jobs, we don’t have to pay taxes.

The government, any government, is large enough that whatever it does or doesn’t do molds the economy. It just can’t help it.

If the government reduces taxes on the wealthy for not investing, it’s possible they won’t invest. The same for corporations. If the government increases taxes on those who just want to keep it in their pocket or the Cayman Islands, that money is likely going to be invested instead.

Cutting taxes reduces the incentive to create jobs.

Is that just playing intellectual games? No. Comparing the tax rates to the health of the economy proves it, without exception.

Is that just playing intellectual games? No. Comparing the tax rates to the health of the economy proves it, without exception.

The chart covers 1913, the beginning of the income tax, to 2003, the last rate change. It begins low but increases to pay for WWI. Conservative dogma created the trough of the 1920s, which lead to the Great Depression. During our most productive period it was in the 90s. The latest lows lead to the present economy.

If you see what you think is an exception, be careful. The game may have been distorted by borrowing large amounts of money. You can enjoy a better lifestyle on a credit card – temporarily. The problem is that paying it back removes much needed investment resources from the game. Debt repayment does not create jobs.

The real reason many of these politicians propose tax cuts has nothing to do with aiding the economy. It is to implement the goal of one of the most ridiculous ideologies ever conceived. They wish, as one wag said, to shrink government to such an extent that it can be drowned in a toilet. Real sophisticated philosophy.

Why eliminate government? To eliminate regulation. Regulations would be unnecessary if everyone behaved. They don’t.

Why eliminate government? To eliminate regulation. Regulations would be unnecessary if everyone behaved. They don’t.

Just look at the results of the greed that helped Wall Street take over half of all the profit in the country. They did this without producing anything but paper and economic disaster.

Much regulation addresses criminal activity: theft, fraud, et al. A regulation is just a type of law. How about getting rid of laws against theft, murder, assault, and such? A good idea? Of course there are stupid regulations. There are stupid laws. Does that suggest that the answer is to eliminate all laws or the government? No. It suggests reviewing the regulations and laws to take reasonable action.

If the people touting reduced taxes for corporations and the elite actually believe that it would create jobs or improve the economy they are fools. Those politicians whining about reducing taxes that know better are tools. You are well-advised to ignore both.

.

.

.